Frequently Asked Questions

See Detailed Explanation About Islamic Finance Types, Benefits & Differences Under FAQ’s

Here are the answers to the questions a buyer might ask about Halal Financing:

What is Halal Financing?

- Halal Financing is a financial system that operates in compliance with Islamic law (Shariah), which prohibits interest (Riba), gambling (Maysir), and excessive uncertainty (Gharar). It focuses on profit-sharing, asset-backed financing, and ethical investments.

Is Halal Financing available for home loans?

- Yes, Halal Financing is available for home loans. You can use options like Murabaha (Cost-Plus Financing), Ijara (Lease-to-Own), and Musharaka (Partnership Financing) to buy a home without engaging in interest-based transactions.

What types of Halal Financing options are there?

- Common types of Halal Financing include:

- Murabaha: A cost-plus financing agreement where the lender buys an asset and sells it to the borrower at a higher price.

- Ijara: A lease-to-own agreement where the borrower rents the asset with the option to own it at the end of the term.

- Musharaka: A partnership financing structure where both the borrower and lender share ownership and profits/losses.

- Mudaraba: Profit-sharing financing where one party provides capital and the other provides labor/expertise.

- Sukuk: Islamic bonds based on asset ownership.

- Takaful: Islamic insurance based on mutual assistance.

- Common types of Halal Financing include:

How is Halal financing structured?

- Halal financing structures vary by product but all avoid interest and focus on ethical transactions. For example, in Murabaha, the lender purchases the asset and sells it to the borrower for a fixed markup. In Ijara, the borrower rents the asset with an option to buy it later. Payments are made through regular installments.

Does Halal Financing charge interest?

- No, Halal financing does not charge interest (Riba). Instead, it involves fixed profit margins, rent, or shared profits based on ethical principles, ensuring the transaction does not violate Shariah law.

What happens if I cannot make a payment?

- In Halal financing, the lender may offer flexible options to help the borrower. However, it depends on the contract. For example, in a Murabaha contract, you may face late payment fees, but the lender cannot charge interest. In Ijara or Musharaka, payment flexibility may be provided through renegotiation.

Is Halal Financing more expensive than traditional financing?

- The cost of Halal financing depends on the terms of the agreement, but it can be higher than traditional financing due to the lender’s profit margin. However, since no interest is involved, the overall cost is typically clear and fixed upfront, without surprises.

Is Halal Financing safe?

- Halal financing is considered safe as it adheres to Islamic principles and is regulated by Shariah-compliant standards. The lender and borrower share risk, and the transactions are based on tangible assets, which adds an element of security.

How long does it take to get Halal Financing approved?

- The approval process for Halal financing is similar to traditional financing, though it may take slightly longer due to the need to ensure the transaction complies with Shariah principles. Approval time varies by lender and the complexity of the financing.

Can I use Halal financing for a mortgage or other types of loans?

- Yes, Halal financing can be used for mortgages, car loans, personal loans, and business financing. Each type of loan uses different structures like Murabaha for mortgages, Ijara for leasing, or Musharaka for partnerships.

Are there specific requirements to qualify for Halal Financing?

- Halal financing requirements generally include creditworthiness, a stable income, and the ability to repay. However, you must also ensure the property you are purchasing complies with Islamic law (i.e., it should not involve alcohol, gambling, or other haram activities).

How does the payment schedule work in Halal financing?

- Payments are typically fixed and structured into monthly installments over an agreed period. In Murabaha, you repay the cost of the asset plus the agreed profit margin. In Ijara, you pay regular rent until ownership transfers. In Musharaka, you gradually buy out the lender’s share.

Is the property I buy with Halal financing restricted in any way?

- Yes, the property must comply with Islamic principles. This means it should not be used for activities like gambling, alcohol sales, or any other haram (forbidden) practices. The lender will ensure the property is Shariah-compliant.

What happens if I want to sell the property before the loan is paid off?

- In Murabaha, you can sell the property anytime but must pay off the remaining balance of the loan. In Ijara and Musharaka, early sale or transfer is possible, but it may require settling the remaining share with the lender and any agreed terms.

Are Halal Financing institutions regulated?

- Yes, Halal financing institutions are regulated by Shariah boards and must comply with the laws of the country they operate in. These boards ensure that financial products and services meet Islamic principles and avoid unethical practices.

These answers help clarify the key aspects of Halal Financing and guide buyers through the process of home purchasing while staying compliant with Islamic principles.

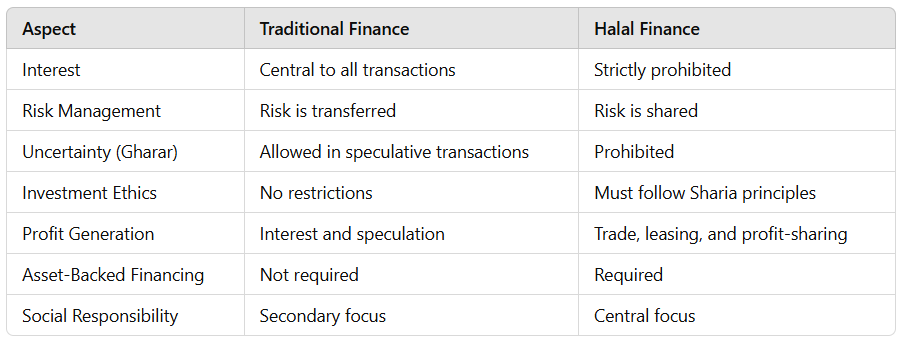

Traditional Finance vS Halal Finance

What is Riba?

Riba is an Arabic term that translates to “increase,” “excess,” or “usury” in English. In Islamic finance, it refers to the practice of charging or paying interest on loans or other financial transactions, which is strictly prohibited under Islamic law (Shariah).

Types of Riba

Riba Al-Nasiah (Interest on Loans)

- This is the most common form and refers to interest charged on borrowed money.

- Example: A borrower takes $1,000 and is required to repay $1,100 after a year. The extra $100 is considered Riba.

Riba Al-Fadl (Excessive Exchange)

- Occurs in trade when two items of the same type are exchanged unequally or unfairly.

- Example: Exchanging 1 kilogram of wheat for 1.5 kilograms of wheat, where the excess 0.5 kilograms is Riba.

Why is Riba Prohibited in Islam?

The prohibition of Riba is deeply rooted in Islamic principles of justice, fairness, and ethics. Here are the main reasons:

Exploitation and Inequality

- Charging interest can exploit the borrower, especially when they are in a vulnerable financial position.

- Wealth accumulates disproportionately for lenders while borrowers often struggle under debt.

Wealth Without Effort

- Riba allows lenders to earn money without contributing to economic activity or taking risks, which is against the spirit of Islamic finance.

Social Harm

- Riba can lead to widespread economic disparity, social tension, and financial instability.

Moral Guidance

- Islam encourages mutual help, risk-sharing, and fairness in financial dealings, which Riba contradicts.

Riba in Islamic Texts

Quranic Verses

- “Those who devour Riba will not stand except as one stands whom the devil has driven to madness. That is because they say: ‘Trade is just like Riba.’ But Allah has permitted trade and forbidden Riba.” (Surah Al-Baqarah, 2:275)

- “O you who believe! Fear Allah and give up what remains of your demand for Riba if you are indeed believers.” (Surah Al-Baqarah, 2:278)

Hadith (Sayings of Prophet Muhammad ﷺ)

- “The Prophet (SAW) cursed the one who consumes Riba, the one who pays it, the one who writes it down, and the two witnesses to it. He said, ‘They are all the same.’” (Sahih Muslim)

Alternatives to Riba in Islamic Finance

Islamic finance offers ethical alternatives that comply with Shariah principles:

- Profit-Sharing: Partnerships like Mudaraba or Musharaka.

- Trade-Based Financing: Using Murabaha (cost-plus financing).

- Leasing: Ijara (lease-to-own models).

These methods promote fairness, shared risk, and ethical wealth generation.

Traditional Finance vS Halal Finance

1. Basis of Operation

- Traditional Finance:

Operates on the principle of profit maximization, often relying on interest-based transactions (riba), risk transfer, and speculative activities. - Halal Finance:

Operates under Sharia law, ensuring financial transactions are free of interest, excessive uncertainty (gharar), and unethical practices like gambling (maysir). It emphasizes fairness, shared risk, and ethical investment.

2. Interest (Riba)

- Traditional Finance:

Interest is the foundation of traditional finance. Lenders charge interest on loans, which represents their profit, regardless of whether the borrower succeeds or fails. - Halal Finance:

Interest is strictly prohibited. Instead, profits are earned through tangible assets, risk-sharing, or trade-based transactions, such as Murabaha (markup sales) or Musharaka (partnership).

3. Risk Sharing vs. Risk Transfer

- Traditional Finance:

Risks are often transferred from one party to another. For instance, in a conventional loan, the borrower bears the full financial risk, while the lender profits through fixed interest regardless of outcomes. - Halal Finance:

Promotes risk-sharing. In models like Musharaka (joint ownership) or Mudaraba (profit-sharing), both parties share profits and losses, fostering a partnership approach.

4. Gharar (Uncertainty)

- Traditional Finance:

Speculative transactions are common, such as derivatives, options, and short-selling. These involve high levels of uncertainty and are focused on making profits from fluctuations in market prices. - Halal Finance:

Prohibits excessive uncertainty. All contracts must have clear terms and conditions, ensuring transparency and fairness. Transactions should be tied to real assets or services.

5. Ethical Investment

- Traditional Finance:

Does not restrict where money is invested, meaning funds can be directed toward industries such as alcohol, gambling, weapons, or tobacco. - Halal Finance:

Ensures investments are in ethical and socially beneficial industries. Prohibited sectors include those involving alcohol, gambling, pornography, and non-halal food production.

6. Profit Generation

- Traditional Finance:

Profits are primarily generated through interest on loans or speculative investments. - Halal Finance:

Profits come from trade, asset ownership, leasing, or profit-sharing arrangements. All earnings must be tied to productive economic activities.

7. Social Responsibility

- Traditional Finance:

Focused on individual profit, with less emphasis on the broader social impact of transactions. - Halal Finance:

Prioritizes social welfare, fairness, and justice. For example, Qard Hasan (benevolent loans) are provided without interest to support those in need, fostering community development.

8. Ownership and Asset-Backed Transactions

- Traditional Finance:

Loans are typically not tied to tangible assets; they are contractual obligations backed by the borrower’s promise to pay. - Halal Finance:

Requires transactions to be asset-backed. For example, in Ijara (lease financing), the lender owns the asset being leased until ownership transfers to the borrower.

9. Default and Penalties

- Traditional Finance:

Lenders often impose high penalties for late payments or defaults, increasing the borrower’s financial burden. - Halal Finance:

Penalties are not profit-driven. Any fees charged are used for charitable purposes, ensuring fairness and compassion.

Types Of Halal Financing

1. Murabaha (Cost-Plus Financing)

- Principle:

Murabaha avoids riba (interest) by ensuring a fixed markup is agreed upon at the time of sale instead of charging interest over time. - Process:

- The lender (e.g., Islamic bank) purchases the asset on behalf of the borrower.

- The lender sells the asset to the borrower at an agreed markup price.

- The borrower repays the total price in fixed installments over time.

- Applications:

Commonly used for home purchases, car financing, and personal loans. - Example:

If a home costs $500,000, the lender buys it and sells it to the borrower for $550,000, payable in monthly installments.

2. Ijara (Lease-to-Own)

- Principle:

Ijara focuses on leasing rather than lending money, avoiding interest-based transactions. - Process:

- The lender buys the asset (e.g., property, car, or equipment).

- The borrower uses the asset by paying regular lease payments.

- At the end of the lease term, ownership is transferred to the borrower, either as a gift or through a nominal purchase price.

- Applications:

Used for property or equipment financing, especially when the borrower cannot afford upfront costs. - Example:

A borrower pays $2,000 monthly rent for a property over 10 years. At the end of the term, the property ownership transfers to them for a token amount.

3. Musharaka (Partnership Financing)

- Principle:

Musharaka promotes joint ownership and shared risk. Profits and losses are divided based on the percentage of ownership. - Process:

- The borrower and lender jointly invest in a property or business.

- The borrower gradually buys out the lender’s share over time.

- Profits from the asset are distributed based on ownership until the borrower owns the full asset.

- Applications:

Often used in home financing, business investments, and real estate development. - Example:

If a borrower provides 30% of the cost of a property, the lender provides 70%. The borrower pays rent on the lender’s share and gradually purchases it.

4. Mudaraba (Profit-Sharing)

- Principle:

Mudaraba involves a partnership where one party provides capital, and the other provides expertise or labor. Profit is shared, but losses are borne by the capital provider unless due to negligence. - Process:

- The lender (capital provider) invests in a project or business.

- The borrower (manager) runs the project or business.

- Profits are divided according to a pre-agreed ratio.

- If the business incurs a loss, the lender loses the capital, while the borrower loses time and effort.

- Applications:

Common for business ventures, project financing, and investment funds. - Example:

A lender invests $100,000 in a business. Profits are split 60% to the lender and 40% to the manager.

5. Sukuk (Islamic Bonds)

- Principle:

Sukuk certificates represent ownership in a tangible asset, avoiding interest payments associated with conventional bonds. - Process:

- Investors purchase sukuk certificates, which entitle them to a share of an asset or project.

- Returns are generated from the revenue or lease income of the asset.

- At maturity, the asset is sold, and proceeds are distributed to investors.

- Applications:

Used for infrastructure projects, real estate development, and corporate financing. - Example:

An investor buys a sukuk linked to a shopping mall, receiving a share of rental income over 5 years.

6. Takaful (Islamic Insurance)

- Principle:

Takaful is a cooperative insurance system based on mutual assistance and shared responsibility. It avoids uncertainty and interest. - Process:

- Participants contribute to a shared fund.

- The fund covers losses or claims for participants in need.

- Any surplus is redistributed among participants or reinvested.

- Applications:

Provides coverage for health, life, property, and business insurance. - Example:

A group of individuals contributes monthly to a fund for health insurance. If one falls ill, their medical expenses are covered by the fund.

7. Qard Hasan (Benevolent Loan)

- Principle:

A Qard Hasan is a loan extended without interest, purely for goodwill and to help the borrower in times of need. - Process:

- The lender provides a loan with no profit margin or interest.

- The borrower repays the principal amount only.

- Applications:

Often used for personal emergencies, education, or small business financing. - Example:

A lender provides a $5,000 loan to help someone start a business, requiring repayment within 12 months without any additional charges.

Each type of halal financing is designed to ensure ethical and equitable transactions while adhering to Islamic principles. They are increasingly popular and available through Islamic banks and financial institutions worldwide.

اللَّهُ أَعْلَمُ

Contact Us For Any Assistance Or guidance

If you’re interested in learning more about Halal financing or a FREE Consultation to get started, feel free to reach out. I’m happy to provide the information and help guide you through the process.

📞 Call or text: (587) 896-SOLD (7653)

📧 Email: Sleman@Usmanee.com

Disclaimer:

Sleman Usmanee is not an Islamic Scholar, mortgage broker or a financial advisor. The information provided here is based on general knowledge and resources about Halal financing. For religious guidance, please consult with a qualified Islamic scholar and for financial advice please consult with a finance professional.